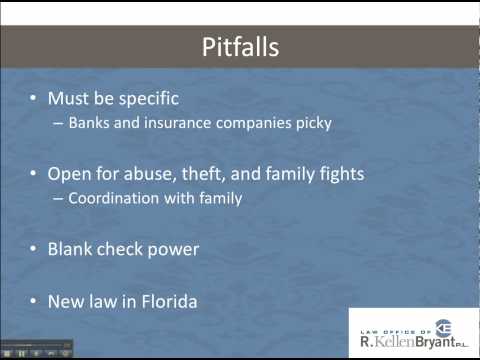

Hi, I'm Kellen Bryant and I'm here to tell you about durable power of attorney in Florida and how this video can save you $5,000. Durable power of attorney is a document that allows you, the principal, to give someone else the power to act on your behalf if you cannot. This can be either if you're incapacitated or not incapacitated. The durable power of attorney document itself should be very specific on what the attorney-in-fact or agent can and cannot do, and the limitations of their power. So that's the basics. What happens if you don't have a power of attorney and you need someone to do things such as cash a check for you, make a payment, sell an asset, or apply for a government benefit? In most cases, you're going to need a guardianship, which is a court-supervised proceeding whereby the court needs to make a determination if you're incapacitated through expert witnesses. They don't charge a high sum, and then the court makes that decision. Then annually, your guardian will need to make a report to the court about expenses on your behalf. Guardianship takes time and money, and that can add up over time to at least five thousand dollars. So, where are the pitfalls if you do decide to make a power of attorney? The durable power of attorney person needs to be specific, and this is about the new law and for about durable powers of attorney. The banks and insurance companies are generally the folks that take the durable power of attorney when you need to use them, and they want specific language on what the agent or attorney-in-fact can and cannot do. So general language in a power of attorney might not suffice, and your attorney-in-fact might not be able to...

Award-winning PDF software

2848 for deceased taxpayer Form: What You Should Know

This is because a power of attorney must be signed in the presence of the named beneficiary or if the beneficiary is a minor, in the presence of his legal representative. To sign a power of attorney, the decedent's executor, personal representative and the third party must all agree that the person (other than the decedent or his legal representative) represents the decedent and his surviving family member and has sufficient knowledge to act for them. When is a power of attorney required? Power of attorney is required in certain situations when a person who has authority to act for the decedent acts on the decedent's behalf. For instance, the decedent's physician may need to notify the IRS. Example: John has authority to act on behalf of John and his parents, who have a life expectancy of 10 years or less. John also has authority to act on behalf of a decedent if he is named executor or de facto legal guardian for the decedent's estate or if he is the named surviving spouse on the decedent's estate. On the day of the decedent's death, John can give orders to the doctor or emergency room staff for blood tests, medical care, the examination of his parents, or other services necessary to treat the decedent's severe physical or mental condition. After this, John then has authority to sign medical orders and to prepare statements for the decedent and any doctors, hospitals, hospices, or other health care providers he may consider. If John dies or is unable to act on behalf of John, he can delegate the duties to his personal representative, who is, in turn, required to give John such instructions as may be found in the power of attorney. What information is required to sign the power of attorney? At a minimum, the decedent's physician must sign the form. The decedent's spouse must sign the form if the decedent was married at the time of the decedent's death. If the decedent was not married but was living with a spouse for at least six months prior to the decedent's death, the decedent's personal representative must sign. The personal representative of a decedent under a valid power of attorney who has not died or is incapacitated by reason of a disability or illness must sign.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form instruction 56, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form instruction 56 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form instruction 56 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form instruction 56 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 2848 for deceased taxpayer